With many mortgage scams going unreported, as ill intent can be difficult to prove, it’s important to be able to identify common scams you might encounter.

Common mortgage scams include:

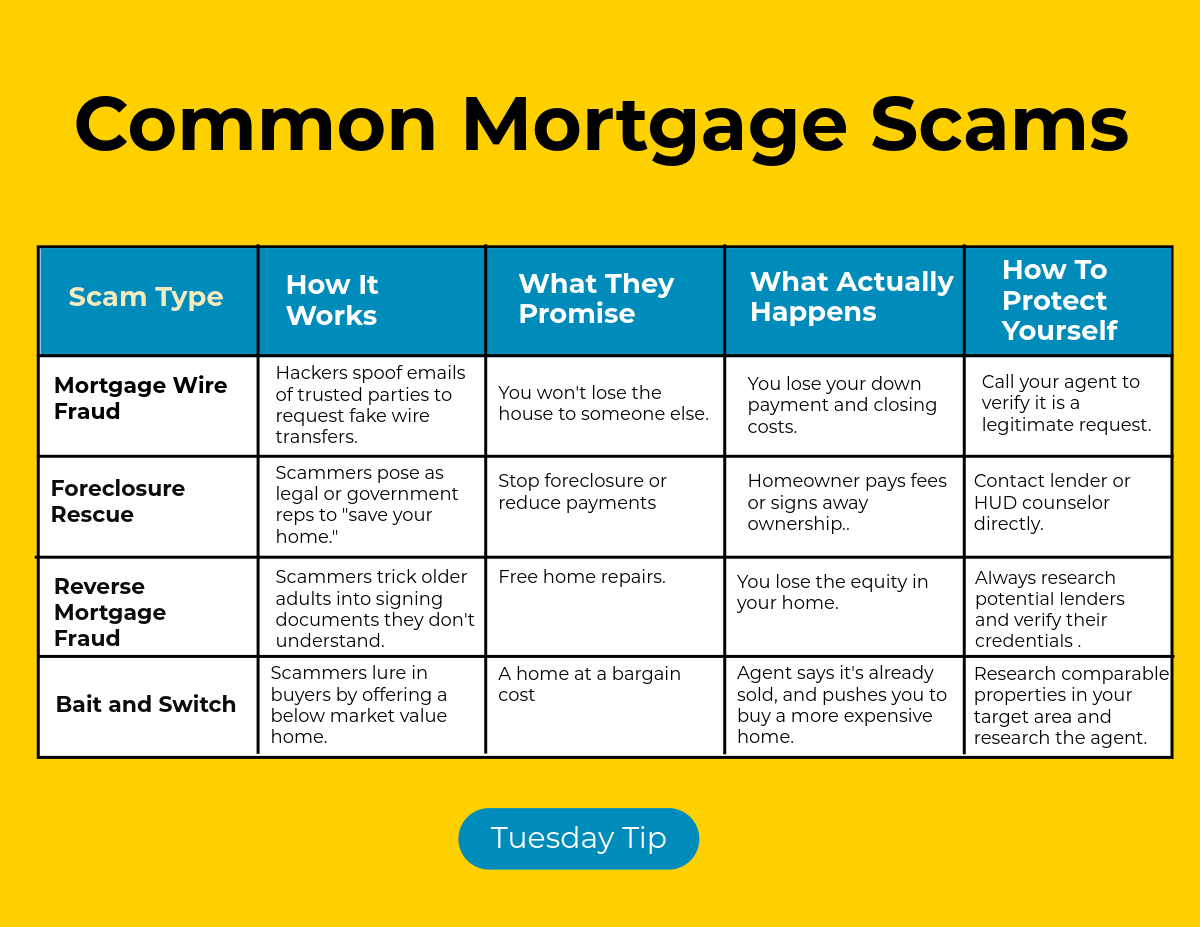

Mortgage Wire Fraud

Mortgage wire fraud is carried out by scammers who impersonate escrow officers, real estate agents, or the lender. In this scheme, they attempt to get the prospective homeowner to wire funds into an illegitimate account for financial gain during the closing process. These sophisticated mortgage scams often include criminal organizations and untraceable offshore accounts, making the funds nearly impossible to recoup. Mortgage wire transfer scammers may attempt to hack legitimate email addresses or send the buyer phishing emails posing as someone involved in the transaction. They’ll monitor pending sales and, as the closing date nears, send fraudulent instructions to wire the closing funds.

Bottom Line: Wiring instructions should be voice verified by a trusted contact, preferably by someone that you have already been working with on the mortgage transaction, such as your loan officer, title agent, or realtor. Before sending any type of payment, authenticate the receiving account with your bank. Always double-check that incoming emails have legitimate addresses and watch out for common red flags, like grammatical errors and excessive urgency. If you are a victim of this kind of activity, it is important to notify law enforcement, the other parties to the transaction, and your bank, as soon as possible.

Foreclosure scams

Homeowners in financial distress are a common target for mortgage scammers. Predatory lending schemes use a variety of methods, like equity skimming, loan modification, and rescue and relief schemes to take advantage of vulnerable homeowners.

In short, these tactics offer to pay the mortgage or “save” the home of a homeowner in financial distress. Let’s explore a few common types of foreclosure scams:

Equity stripping: Equity skimming, or equity stripping, takes place when a homeowner defaults on their loan, and a predatory investor offers to purchase their property to avoid foreclosure. The investor then gains the deed to the home and leases the property to a third party or back to the existing owner. The perpetrator then pockets the rental income (which is typically inflated), refinances the mortgage to strip the equity, and flips the home while the abandoned homeowner is still indebted to the obligations of the original mortgage.

Loan modification and foreclosure relief scams: With a loan modification scheme, scammers misrepresent themselves as government officials or attorneys and offer to negotiate the terms of a mortgage to avoid foreclosure. In exchange for the agreed service, they charge high fees that are due upfront. Generally, they either negotiate unfavorable terms that result in eventual foreclosure or fail to negotiate new terms at all.

Bottom Line: Prior to working with a third party, you should seek help directly with your lender or service provider. Always verify the credentials of mortgage relief service providers with the U.S. Department of Housing and Urban Development (HUD) prior to opting into their services. Reverse mortgage scams

Reverse mortgage fraud

Reverse mortgage fraud is a scheme that takes advantage of home equity conversion mortgages (HECM), which are insured by the Federal Housing Administration.

A HECM is intended for senior homeowners, ages 62 and older, who own their primary residence. The program offers seniors the ability to withdraw a portion of their home’s equity to use for home maintenance, repairs, or general living expenses. Scammers take advantage of the program by recruiting seniors and applying for the loan on their behalf based on an inflated appraisal. While the homeowner continues to pay property taxes and insurance, they’re offered a portion of the payment, while the scammer skims the remainder.

Because the HECM program doesn’t require repayment until the homeowner no longer lives in the property, the original lender often doesn’t recognize the scam until the homeowner passes away or sells their home, at which time the entire loan plus interest accrued is due. This can cause any equity in the victim’s home to be completely lost.

Bottom Line: Be wary of programs that imply reverse mortgages are a government benefit instead of a loan with a repayment structure.

Bait-and-Switch Scams

The bait-and-switch tactic entices buyers with impressive terms and mortgage rates, which are often far better than typical rates being offered.

Once the buyer signs on, those terms are then flipped or they’re told they no longer qualify for the lower rate. This leaves home buyers stuck with fees, high rates, or unattractive loan terms. If the buyer backs out of the transaction, they may lose earnest money or other deposits or down payments that they have already made. Because rate changes happen often in legitimate settings and it’s possible for additional fees from Fannie Mae and Freddie Mac to be added to your loan after the estimate, these scams can be difficult to discover and difficult to prove.

Specific types of mortgages, like negative amortization home loans and balloon loans, may have the same classification, as buyers are lured into these loans with impressive or nonexistent interest rates that become unaffordable after the end of the set introductory period.

Bottom Line: It is important to shop around for a mortgage lender and to get at least three offers-in writing so that you can compare them. These offers will be in the form of a loan estimate, which is a standard form showing important facts about the loan. You should ask your chosen mortgage lender to lock in your interest rate with a breakdown of fees. With your rate lock confirmation, you’ll also get a loan estimate to compare rates across other lenders. Here is another great resource: Your home loan toolkit: A step-by-step guide

Loan Flipping

Loan flipping, also known as loan churning, is the process of continually refinancing a borrower’s mortgage in attempts to collect fees for financial gain. This tactic has virtually no benefits to the borrower, as they can add transaction fees and closing costs that result in a longer term and additional debt. Loan flipping is different from illegal property flipping where a borrower purchases a home at a higher appraised value than it’s worth and sells it quickly after purchase.

Bottom Line: Look at the overall costs of refinancing your mortgage loan, including the interest rate, closing costs, and fees across the new loan term, which may be extended.

Fake real estate agent

Real estate broker fraud typically occurs when an agent misrepresents themselves or misinforms a buyer. In some cases, a fake real estate agent may falsify credentials with a fake license, background, or work history. Alternatively, a real estate agent may not follow full disclosure requirements about a property’s age, defects, or foreclosure status. These fraudulent agents may also try to rent out a home that’s currently being foreclosed on or is currently for sale.

Bottom Line: Verify your agent’s license number and license status before conducting business with them. The Nebraska Real Estate Commission maintains a licensee search feature on its website, nrec.nebraska.gov