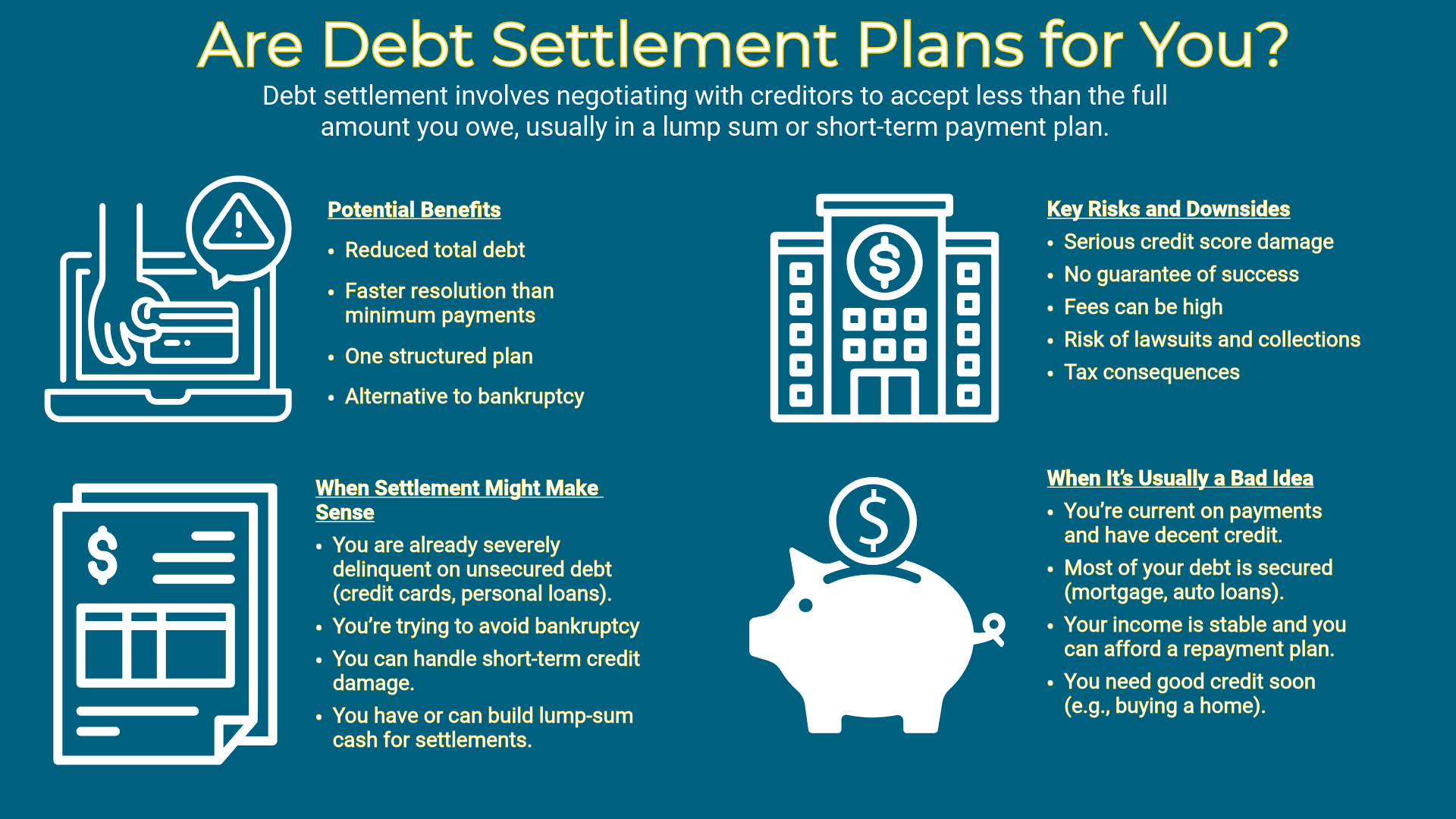

Debt settlement programs can be helpful in the right situation, but they also come with real risks. Here’s a clear, balanced breakdown to help you decide whether they’re worth considering.

What Is Debt Settlement?

Debt settlement involves negotiating with creditors to accept less than the full amount you owe, usually in a lump sum or short-term payment plan. These programs are often offered by third-party companies that negotiate on your behalf.

Potential Benefits:

Reduced Total Debt

- Creditors may agree to accept 30–60% of the balance owed.

- Can significantly lower the amount you need to repay.

Faster Resolution Than Minimum Payments

- Many programs aim to settle debts within 2–4 years, compared to decades of minimum payments.

One Structured Plan

- Instead of juggling multiple creditors, you make one monthly payment to the settlement program.

Alternative to Bankruptcy

- For some people, settlement feels less extreme than filing for bankruptcy and may avoid court involvement.

Key Risks and Downsides

Serious Credit Score Damage

- You usually stop paying creditors during negotiations.

- Missed payments and “settled for less than full balance” marks can lower your credit score significantly.

- Credit damage can last up to 7 years.

No Guarantee of Success

- Creditors are not required to settle.

- Some may refuse or pursue collections or lawsuits instead.

Fees Can Be High

- Settlement companies often charge 15–25% of enrolled debt.

- Fees may offset some of the savings.

Risk of Lawsuits and Collections

- While negotiations are ongoing, creditors may:

- Send accounts to collections

- File lawsuits

- Garnish wages

Tax Consequences

- Forgiven debt over $600 is often treated as taxable income by the IRS.

Scams and Predatory Companies

- Some companies promise unrealistic outcomes or collect fees without delivering results.

When Debt Settlement Might Make Sense

- You are already severely delinquent on unsecured debt (credit cards, personal loans).

- Bankruptcy is the main alternative you’re trying to avoid.

- You can handle short-term credit damage.

- You have or can build lump-sum cash for settlements.

When It’s Usually a Bad Idea

- You’re current on payments and have decent credit.

- Most of your debt is secured (mortgage, auto loans).

- Your income is stable and you can afford a repayment plan.

- You need good credit soon (e.g., buying a home).

Alternatives to Consider

- Nonprofit credit counseling (often free)

- Debt management plans (DMPs) with reduced interest rates

- Direct negotiation with creditors (no middleman fees)

- Bankruptcy consultation (sometimes less damaging long-term)