What Goes Into Your Mortgage Payment?

As a homeowner (or aspiring homeowner), housing costs are likely to be the biggest monthly expenditure for most people. But have you ever wondered what goes into a mortgage payment beyond paying down your loan? Wonder no more.

First of all, what is a mortgage? It is a legal document that pledges a property to a lender as security for payment of a debt. Simply put, if you fail to make payments, your lender can take your home.

When most people talk about mortgages, they’re actually referring to their home loans (unless they’re a lawyer or a bank), but the terms are often used interchangeably by consumers.

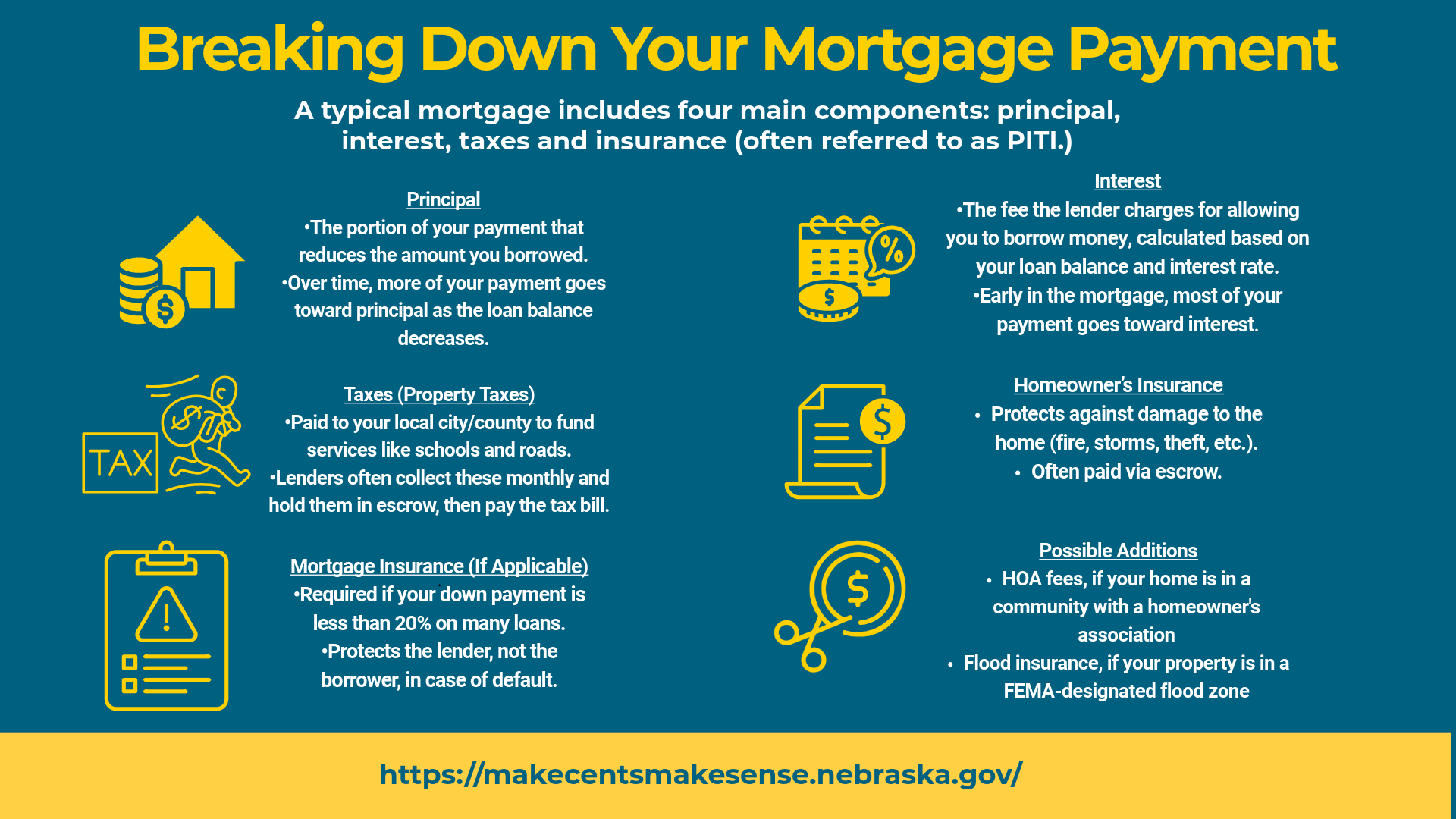

Breakdown of Mortgage Payment Components

A typical monthly mortgage payment is made up of four main parts, commonly referred to as PITI (detailed below):

Principal

- The portion of your payment that reduces the amount you borrowed.

- In a typical “amortized loan”, over time, more of your payment goes toward principal as the loan balance decreases.

- Because so much of your payment, especially in the early years of a home loan, goes to interest, extra payments toward your mortgage principal can save you thousands of dollars over the life of your loan (provided you do not have a pre-payment penalty provision). Whether you pay a little extra every month or make one or more additional payments during the year, the total interest you pay is reduced over the life of the loan

Interest

- The fee the lender charges for allowing you to borrow money.

- Calculated based on your loan balance and interest rate.

- Early in the mortgage, most of your payment goes toward interest. An amortized loan enables payment and interest amounts to be fixed over the life of the loan. This “math” is automatic, yet because interest is paid on the amount of money borrowed. more interest is due when the loan is larger and less interest is due each month as the loan is paid down.

Taxes (Property Taxes)

- Paid to your local city or county to fund services like schools, roads, and emergency services.

- Lenders often collect these taxes monthly and hold them in escrow, then pay the tax bill on your behalf.

- Escrow is a legal word for money you have paid in that is being held for planned other bills. This is NOT an extra fee; simply a savings account to collect the money monthly to have available when the bill comes due. If a lender does not hold escrow, the bills still need to be paid. In that case, the billing is not part of the monthly billing that the bank or mortgage lender manages for you. Common escrowed funds that might be included in your payment calculations include real estate taxes, real estate insurance, flood insurance, and homeowners’ association dues. Keep in mind that if a lender does not collect these funds, it does not mean your “real” payments are cheaper because you are required to pay taxes, insurance, and association dues (where applicable) as terms of the loan.

Insurance

There are usually two types:

Homeowner’s Insurance

- Protects against damage to the home (fire, storms, theft, etc.).

- Often paid via escrow.

Mortgage Insurance (If Applicable)

- May be required if your down payment is less than 20%. According to the Consumer Financial Protection Bureau, mortgages for single-family principal residences that originated after July 29, 1999, must be automatically terminated by the mortgage provider once the borrower’s loan to value ratio reaches 78% of the home’s original value or when the loan reaches the midpoint of its amortization period, whichever occurs first. Once you have more than 20% equity in your home, the insurance will no longer be necessary.

- Protects the lender, not the borrower, in case of default.

Possible Additions (Depending on Your Situation)

- Home Owners Association (HOA) fees, if your home is in a community with a homeowner’s association

- Flood insurance, if your property is in a FEMA-designated flood zone

- Supplemental tax payments, if tax assessments change

Mortgage Payment Component Purpose

- Principal: pays down loan balance; mandatory for everyone

- Interest: cost of borrowing; mandatory for everyone

- Property taxes: local taxes; usually mandatory for everyone

- Homeowners insurance: property protection; mandatory for everyone

- Mortgage insurance: mandatory for everyone with a down payment less than 20%; you can stop paying for PMI when you have more than 20% equity in your home.

- HOA fees: community amenities; only if your home is in a community with a homeowner’s association