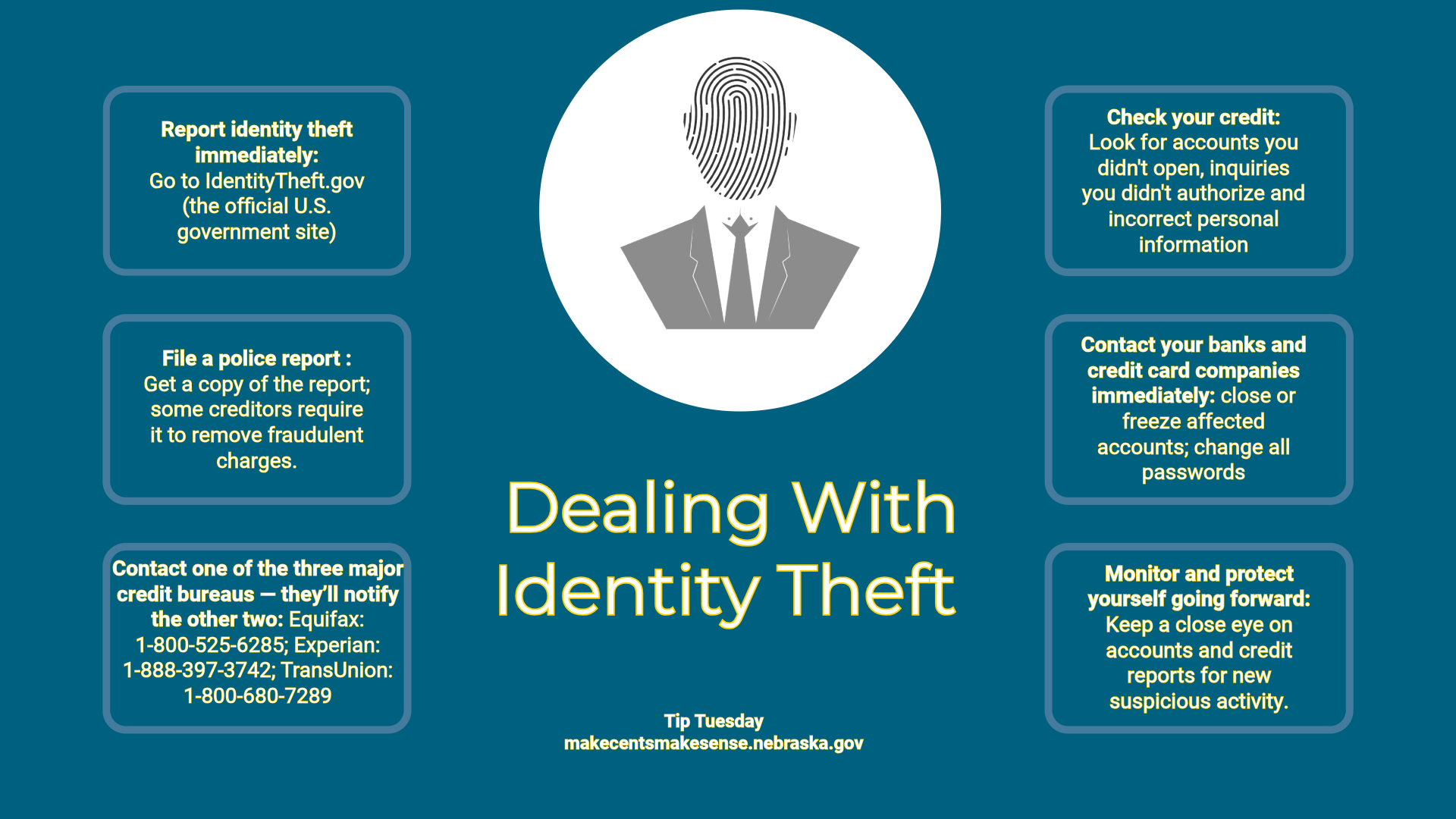

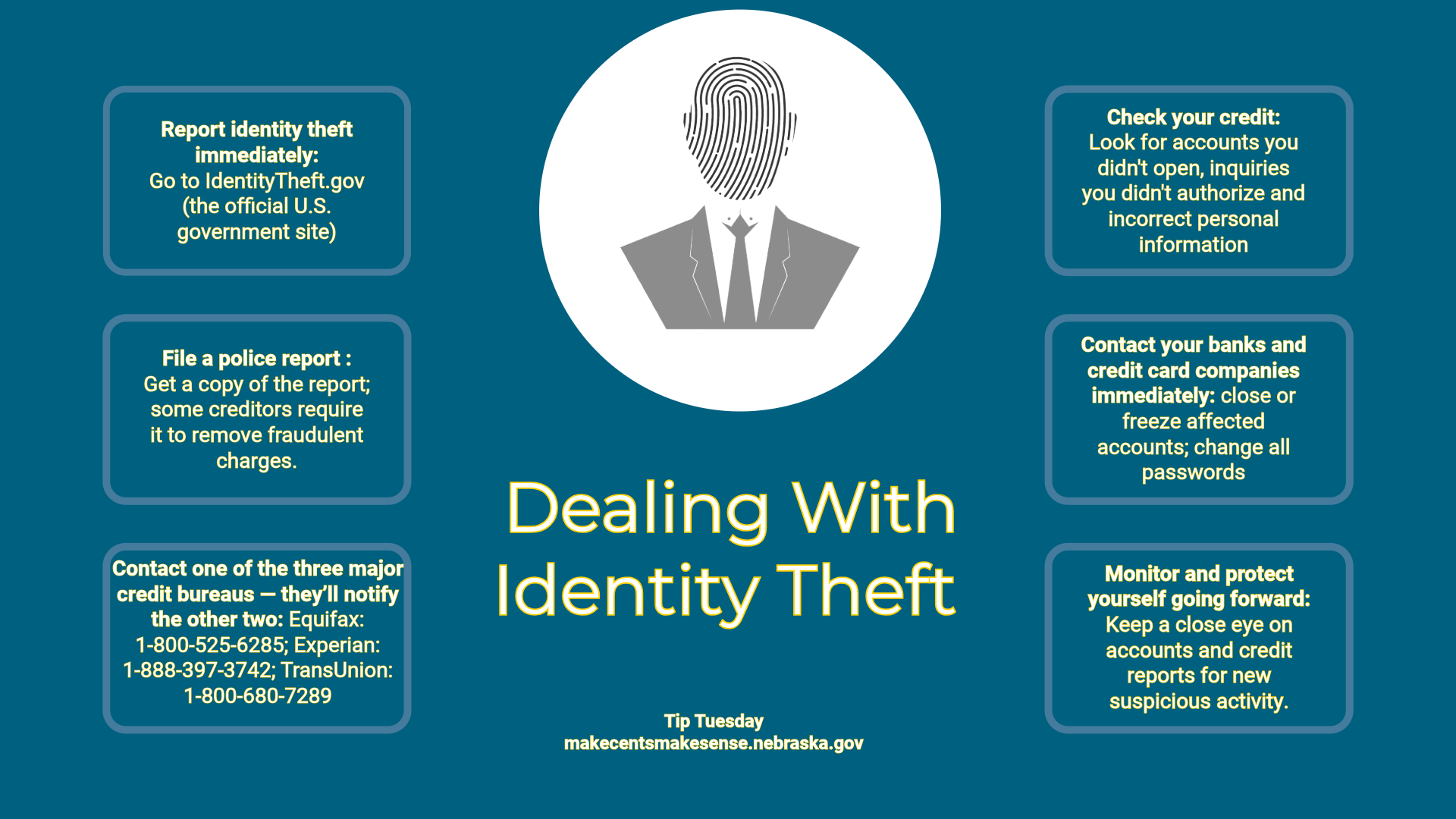

If you’re the victim of identity theft, it’s important to act quickly to limit the damage and protect your credit, finances, and personal information. Here’s a clear step-by-step guide on what to do:

Report the Identity Theft Immediately

File a Report With the FTC

- Go to IdentityTheft.gov (the official U.S. government site).

- They’ll help you create:

- An Identity Theft Report (official proof of the theft)

- A recovery plan and sample letters to send to creditors

File a Police Report (required if you have lost money)

- Take your FTC Identity Theft Report and a government ID to your local police department.

- Get a copy of the report — some creditors require it to remove fraudulent charges.

Protect Your Credit Immediately

Place a Fraud Alert (helpful; consider if it will help you.)

- Contact one of the three major credit bureaus — they’ll notify the other two:

- Equifax: 1-800-525-6285

- Experian: 1-888-397-3742

- TransUnion: 1-800-680-7289

- This alert lasts 1 year and warns creditors to verify your identity before opening new accounts.

Consider a Credit Freeze

- A credit freeze blocks anyone (including you) from opening new credit accounts until you lift it.

- You can freeze your credit for free with each bureau.

- It’s stronger protection than a fraud alert.

-

To buy a house, a car, lease a new apartment or obtain a new credit card you may need to unfreeze your account for this purpose and then place the freeze once again. Consider your immediate plans as you consider this option.

Check and Fix Your Credit Reports

- Visit AnnualCreditReport.com to get free copies of your credit reports from all three bureaus.

- Look for:

- Accounts you didn’t open

- Inquiries you didn’t authorize

- Incorrect personal information

- Dispute any fraudulent items directly with the bureaus — use your FTC report and police report as proof.

Secure Your Financial Accounts

- Contact your banks and credit card companies immediately:

- Close or freeze affected accounts.

- Request new account numbers, cards, and PINs.

- Change all passwords, especially for:

- Online banking and credit accounts

- Email and social media (since thieves often use these to reset passwords)

Monitor and Protect Yourself Going Forward

- Keep a close eye on accounts and credit reports for new suspicious activity.

- Consider using credit monitoring or identity theft protection services.

- Update passwords regularly and enable two-factor authentication everywhere possible.

Extra Steps (if relevant)

- If your Social Security number was stolen, contact the Social Security Administration (SSA):

- 1-800-772-1213

- If your tax return was affected, contact the IRS Identity Protection Unit:

- 1-800-908-4490